ASSET MANAGEMENT

In an industry where efficiency and precision drive success, we offer a cutting-edge solution tailored for asset managers - AMDIS.

As businesses face increasing challenges to manage and track more assets than ever, compounded by new regulations, cloud-based solutions, licensed-based data software, and frequent updates, managing investments has become more complex. Whether your focus is on optimizing operational workflows, enhancing decision-making, or driving growth, AMDIS is designed to support your evolving needs. Our software provides an efficient and reliable way to manage these burdens, empowering you to navigate the complexities of modern asset management with confidence.

AMDIS provides a holistic view of financial asset - ensuring you with an overview of all your portfolio, enabling you to make informed decisions regarding your investment strategies. AMDIS complies with evolving business challenges by producing high-quality analytics and reports thanks to its computation engine dedicated to performance, ESG and risk metrics.

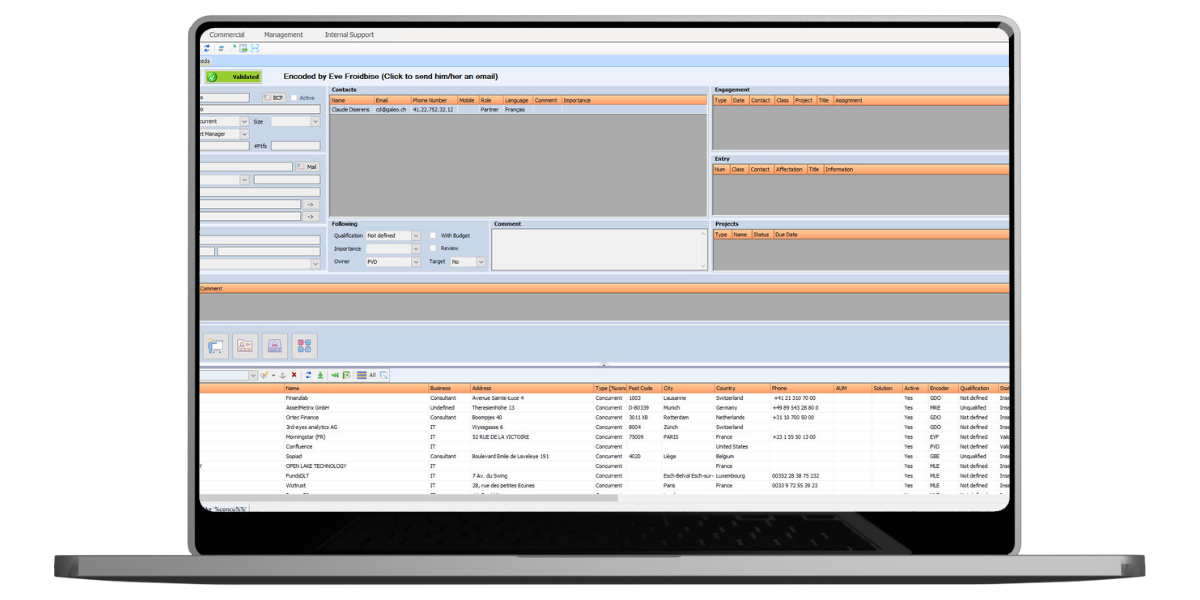

--> Mettre une vidéo de GPMS ou du client portal dans le laptop : front office optimizer (changement de stratégie, rebalancement).

DISCOVER OUR TAILORED MODULES DESIGNED TO SUPPORT YOUR BUSINESS NEEDS

Performance & Risk analytics

- Choice of price providers for performance calculations

- Different methodologies of return calculations

- Indicators and ratios of performance

- Flexibility in period and frequency of calculation

- Comparison to ad hoc benchmarks or model portfolios

- Multi level fund transparency

- Risk attribution to identify which decisions have contributed to overall volatility

Performance attribution

- Auto integration of changes in the benchmark’s weight

- Including interaction, currency effects and chaining algorithms

- Brinson style models for equities and balanced portfolios

- Specific fixed income attribution models, such as

- successive spreads models or successive portfolio models

- Singer and Karnoski for international portfolios

Risk Ex-ante

- Calculation of key risk indicators for alternative investments, maximum drawdown, downside risk, recovery period, Sortino ratio,…

- Calculation of tracking errors and the contribution to tracking errors

- Calculation of Var and CVar under different hypotheses

- Risk models and security models customizations

GIPS

- Definition of firm(s) and composites

- Functionality to manage movement and events in composite

- Associate one or several benchmarks to a composite

- Wide range of standard GIPS compliance reports: Assets Under Management, Composite Performance Review, Composite Analytics, Information for RFP,...

Solvency II

- Generation of the Standard tripartite files and upgrades proposed by the "Club Ampère"

- Position based, by Share classes, management of Derivatives (Forwards, Forex, Futures,...)

- Harmonised standards for valuation of assets, own funds criteria eligibility

- Look-through approach and look-through "proxy"

- Calculation of Solvency Capital Requirements (SCR) Market figures at the asset level

ESG Analytics

- Extensive information at the issuer level

- Connect to every financial and extra-financial metrics on the market

- Combining ESG metrics with performance and risk analytics

- Full comparison with SRI and non-SRI Indices

- Extensive reporting layout to highlight SRI investment method

- Innovative ESG performance attribution methodology integrating ESG investment process

- Best in class

- Negative or positive screening

- Negative or positive screening and best in class

HOT TOPICS