UNLEASH THE POWER OF FLEXIBLE PORTOLIO ANALYSIS WITH

AMINDIS' BUILDING BLOCK APPROACH

In today’s investment landscape, asset owners and asset managers face increasing demands for customized analyses and reports. The shift from standardized processes to fully tailored solutions has made agility a key success factor.

The rise of ESG, new asset classes, and evolving portfolio strategies has added a complexity to portfolio management, demanding in-depth analysis across financial and non-financial metrics. Traditional tools and rigid workflows struggle to keep pace, leaving organizations at risk of inefficiencies, delays, and missed opportunities.

At AMINDIS, we empower financial institutions to navigate these challenges seamlessly with our Building Block approach—a cutting-edge methodology designed to unlock unmatched flexibility and scalability for your portfolio analysis needs.

ADAPTABILITY & RESPONSIVENESS: THE KEY TO SUCCESS

Managing investment portfolios requires the ability to create highly tailored analyses and reports for regulators, stakeholders, internal teams, and evolving market conditions. The challenge lies in:

Adapting to increasingly diverse requirements.

Lacking the necessary methodologies to handle expanding calculations needs.

Scaling processes as they continue to multiply and evolve.

Reducing time to market to remain competitive.

Traditional solutions fall short, offering limited customization and rigid processes that fail to accommodate unique client needs or fast-changing environments.

To stay ahead, financial institutuons need agile, future-proof solutions.

Are you equipped to meet today’s demands while preparing for tomorrow’s challenges?

AMINDIS' BUILDING BLOCK APPROACH: CONFIURABLE, SCALABLE, PRECISE

Our Building Block approach transforms portfolio analysis by giving you the power to configure every aspect of your calculations and reports. With AMINDIS, flexibility becomes your competitive edge.

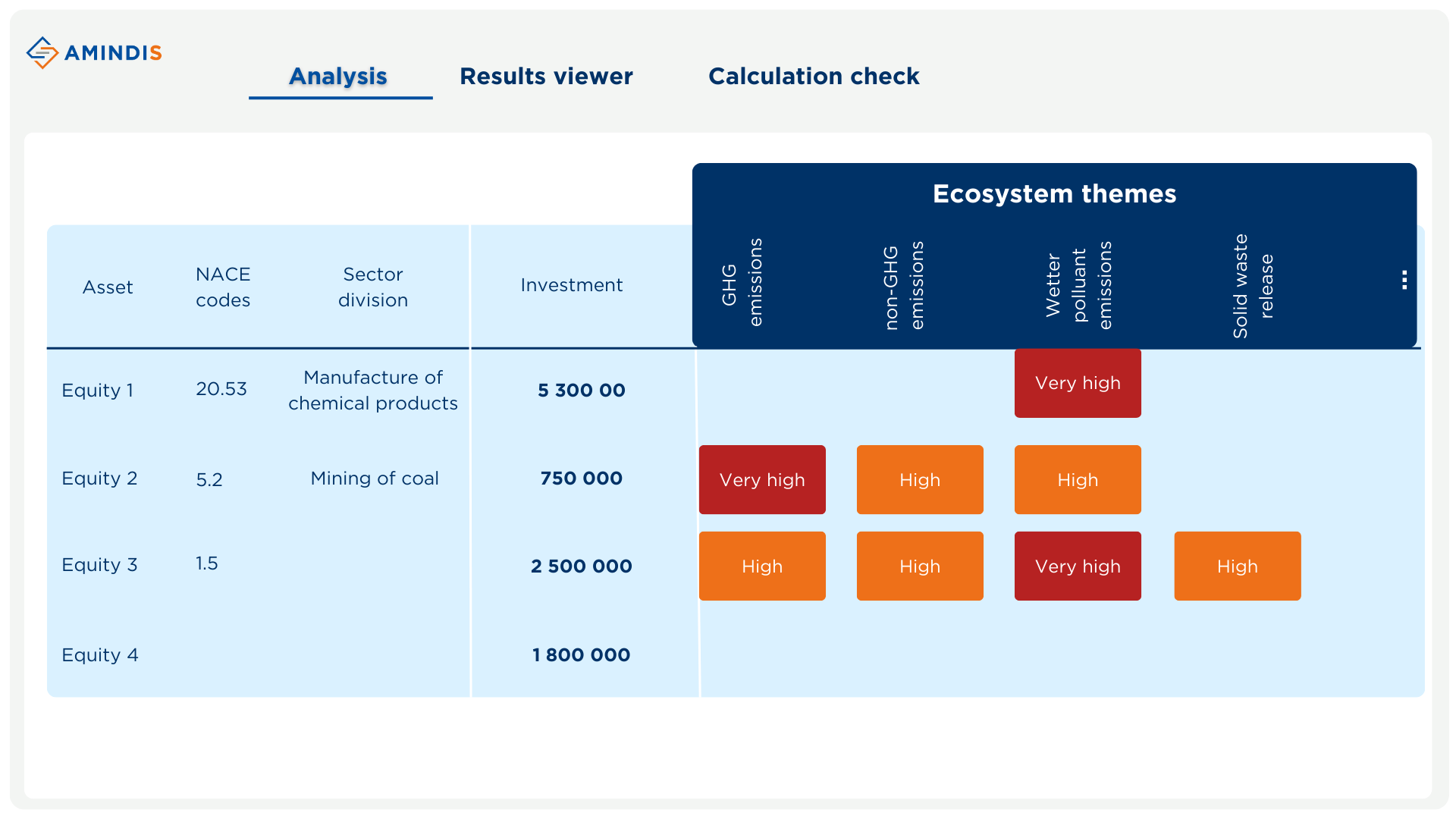

BUILDING YOUR ANALYSIS

BUILDING YOUR ANALYSIS

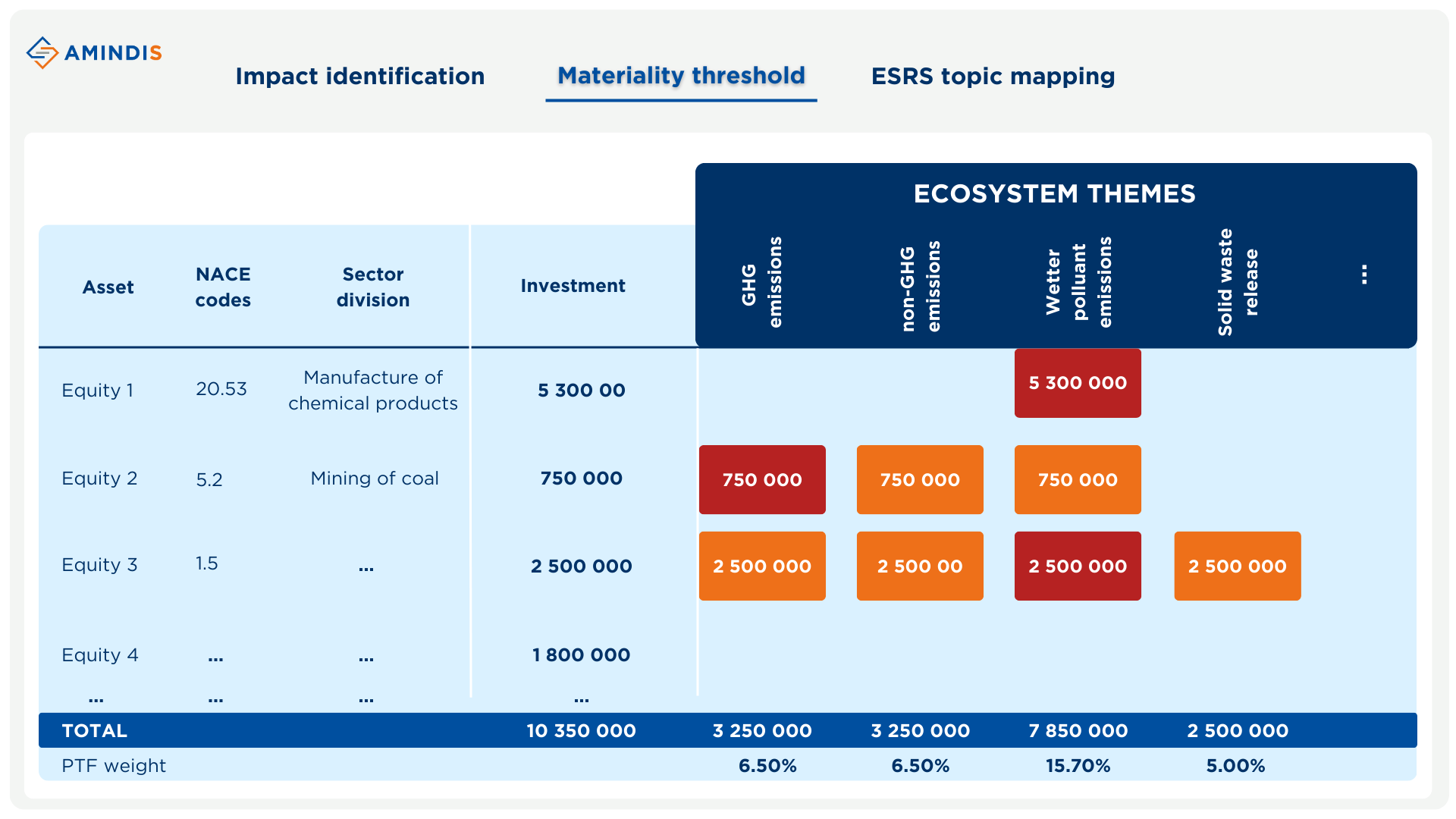

Create your analysis step by step using the Building Block approach, where you can combine as many calculations as you need.

Core elements of our approach:

VISUALIZING RESULTS WITH FLEXIBLE DATA VIEWS

Once your analysis is built, take advantage of dynamic and customizable data views to visualize your results. The visualization process is fully flexible, allowing you to adapt your views based on the context of your analysis.

Context-aware views: the system intelligently selects the most natural layout (e.g., dates as rows in a timeline analysis).

Customization options: instantly switch between 12 display styles—including time trends and weight distributions—with a simple click.

Drill down: gain full transparency by exploring calculation details at any level.

Discover the 12 display styles and how the system intelligently suggests the most relevant visualization while allowing full customization.

C = Criteria F = Calculation D = Date

CHECKING RESULTS WITH FULL TRACEABILITY

Once your analysis is built and visualized, ensuring data integrity is essential. With AMINDIS' Building Block approach, you gain full traceability at every step of the process, allowing you to detet anomalies and verify the accuracy of your calculations.

Identify inconsistencies: easily spot figures that require validation or further review.

Explore calculations logic: navigate through a structured breakdown of all computations, ensuring full transparency.

Drill down into details: investigate each component of an equation, check data reconciliation, and validate results at every stage.

Define custom verification equations: set up tailored validation rules to automatically flag discrepancies and ensure data consistency.

With an intuitive audit trail, step by step validation, and the ability to create your own verification equations, you gain complete confidence in your results, enabling smarter and more raliable investment decicions.

"Flexibility without compromise, that's our vision".

Whether you’re using AMDIS for portfolio management or INDIS for asset ownership analytics, our Building Block approach forms the foundation for tailored solutions that adapt to your needs.

KEY BENEFITS OF THE BUILDING BLOCK APPROACH

AMINDIS delivers real results for your business:

SPEED

Reduce analysis and reporting time by up to 40% with automated workflows and intuitive configurations.

AUTOMATION

Eliminate manual errors and inefficiencies by automating recurring processes, ensuring consistency across your operations.

CONSISTENCY

Achieve unparalleled accuracy, ensuring that all stakeholders receive reliable, transparent reports every time.

Why choose AMINDIS?

Our solutions are built to adapt to your unique needs. With a low-code/no-code philosophy, we empower your teams to take control without the need for extensive development cycles.

Tailored to your needs: whether you're managing investments as an Asset Manager or overseeing assets as an Asset Owner, AMDIS and INDIS are designed to support your specific requirements—empowering you to navigate complex regulatory landscapes and achieve your portfolio goals efficiently.

Rapid deployment: launch projects quickly with our low-code/no-code approach, eliminating lengthy development cycles.

Scalable and cost-effective: both AMDIS and INDIS grow with your business, providing flexibility to adapt as your operations evolve.

Customizable workflows: fully configurable dashboards, workflows, and reports ensure you stay in control, delivering precise and actionable insights.

With AMINDIS, you gain more than just a tool—you gain a partner invested in your success.

EXPLORE MORE: RELATED TOPICS

LOOKING FOR MORE INSIGHTS? DISCOVER HOW OUR SOLUTIONS CAN TRANSFORM YOUR INVESTMENT MANAGEMENT PROCESS:

TAKE THE NEXT STEP

Experience the difference with AMINDIS. Request a personalized demo to see how our Building Block approach can transform your portfolio analysis—whether you’re addressing ESG metrics, optimizing performance, or ensuring regulatory compliance.

Ready to see how our flexible, scalable solutions can empower your portfolio analysis? Discover how AMDIS and INDIS can help you streamline processes, enhance decision-making, and ensure regulatory compliance. Schedule your tailored demo today!

Trusted by leading asset managers and asset owners across Europe.